Gerald Fong

Australia's Largest Specialist Personal Injury Firm^

WINNER Personal Injury Law Firm of the Year

Our Melbourne office is located in the heart of Melbourne’s legal precinct on Lonsdale Street, a short walk from Flagstaff Station.

With Law Partners, you don’t just get a personal injury specialist – you get a specialist in TPD claims just like yours. Your local Melbourne team will work hard for you, check in with you regularly, and always keep you up to date with your case.

You’re in safe hands with Australia’s largest specialist personal injury firm.

We understand that being unable to work due to an injury or illness may be causing you financial stress, and we’re here to help.

It costs nothing to find out how much you can claim. And when you choose Law Partners, your TPD lawyer in Melbourne will get to know you personally and uncover all your entitlements.

A successful TPD claim needs to be backed by watertight proof that your injury or illness meets the criteria in your policy. Our TPD lawyers in Melbourne know what it takes to maximise your claim, and we have a network of hand-picked medico legal specialists who work with us to build successful cases.

We’ll prepare your claim thoroughly and get your lump sum payout for you in the shortest possible timeframe.

TPD (total and permanent disability) is a type of insurance that provides you with a payment if you’re forced to stop work. When you make a TPD claim you’re claiming a lump sum payment on top of your superannuation fund balance.

If you’ve ever paid into a super fund, it’s likely you have TPD insurance connected to your super. If you’ve been off work for three or more months due to injury or illness, with no prospect of returning to work, then you may be eligible to make a TPD claim.

It’s important to note that the definition of TPD varies between policies – for example, your policy might cover you for:

A successful TPD claim needs to be backed by proof that you meet the criteria outlined in your TPD insurance policy. If the insurance assessor decides you don’t meet the criteria, your TPD claim will be rejected.

Yes, if you have more than one TPD policy, you may be able to make multiple TPD claims – one for each policy. This is quite a common situation, as many people have multiple superannuation funds as a result of changing jobs over the years and may have a TPD policy through each fund. Making a successful TPD super claim against one policy has no effect on any other TPD insurance you may have, but you’ll need to submit a separate claim against each policy.

You can make your own claim without using a TPD claim lawyer. However, it’s common for people to have their TPD claims rejected by insurers because they fail to submit a thorough application, including all the documents and medical records needed to substantiate their claims. In other words, many people simply complete the application forms and assume their claim will be approved. But if you do that and fail to supply all the evidence needed to support your claim, it’s like the insurer will either reject your claim or keep asking you for more information, and the process can really drag on. This is why so many people who handle their own claims end up failing to get the TPD compensation they’re entitled to – they simply give up out of frustration.

A specialist TPD claim lawyer can compile all the evidence and submit your claim on your behalf, so the insurance assessor has all the information they need and you’re more likely to get your TPD claim approved.

It can be hard to know how much TPD cover you have, as you may have multiple super funds and TPD policies from changing jobs over the years. If you can’t work and you’re not sure about your cover, call us and we’ll find out for you. It’s a free service.

When claims are simply ‘processed’, important details can be missed. We’ll match you with a specialist TPD lawyer, build a personal relationship with you and your family, and look beyond your obvious injuries or illness to claim everything you’re entitled to. This can make a big difference to the amount of compensation you receive.

A TPD payout is not classed as taxable income, but if you withdraw any part of your TPD payout from your super fund as a lump sum, you may have to pay “superannuation lump sum withdrawal tax”. The amount payable is different for everyone, and if you have multiple super funds, the amount will be different for each fund you make a withdrawal from.

Caring for our clients drives everything we do – that’s why thousands of Australians every year choose Law Partners.

Our senior lawyers will assess your case for free.

As a personal injury law firm, we see first-hand every day the psychological damage that a lack of empathy can cause. So we’re committed to promoting more empathy in the world, and sharing stories of the positive impact it can have.

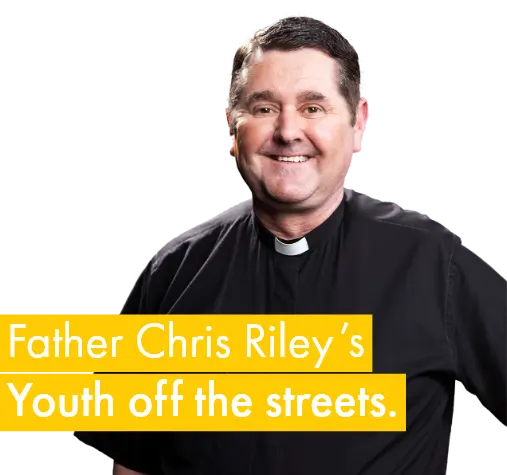

Meet some of the people whose stories inspire us

Request a callback